Business

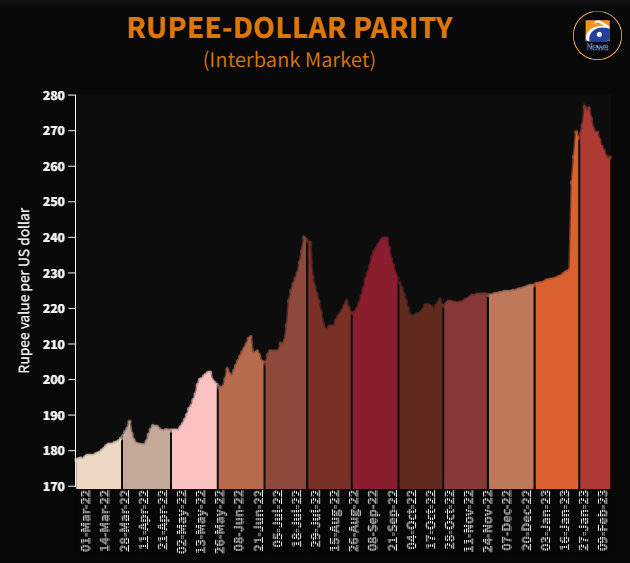

Rupee snaps 5-day long winning streak

-

Latest News3 days ago

Latest News3 days agoThree injured and two died in a Punjabi road accident

-

Business19 hours ago

Business19 hours agoSee the new rates when Pak Suzuki announces a significant decrease in car costs.

-

Latest News19 hours ago

Latest News19 hours agoPoliovirus discovered in ten additional sewage samples

-

Business3 days ago

Business3 days agoPakistan’s $1.1 billion loan tranche is approved by the IMF board.

-

Latest News3 days ago

Latest News3 days agoFazl challenges the authenticity of the parliament.

-

Latest News3 days ago

Latest News3 days agoAfter kidnapping a citizen of Karachi, three AVLC officers were detained.

-

Latest News3 days ago

Latest News3 days agoSheikh Rashid claims he doesn’t communicate with the PTI’s founder or any other leader.

-

Business3 days ago

Business3 days agoPakistan’s fuel prices should drop.