Business

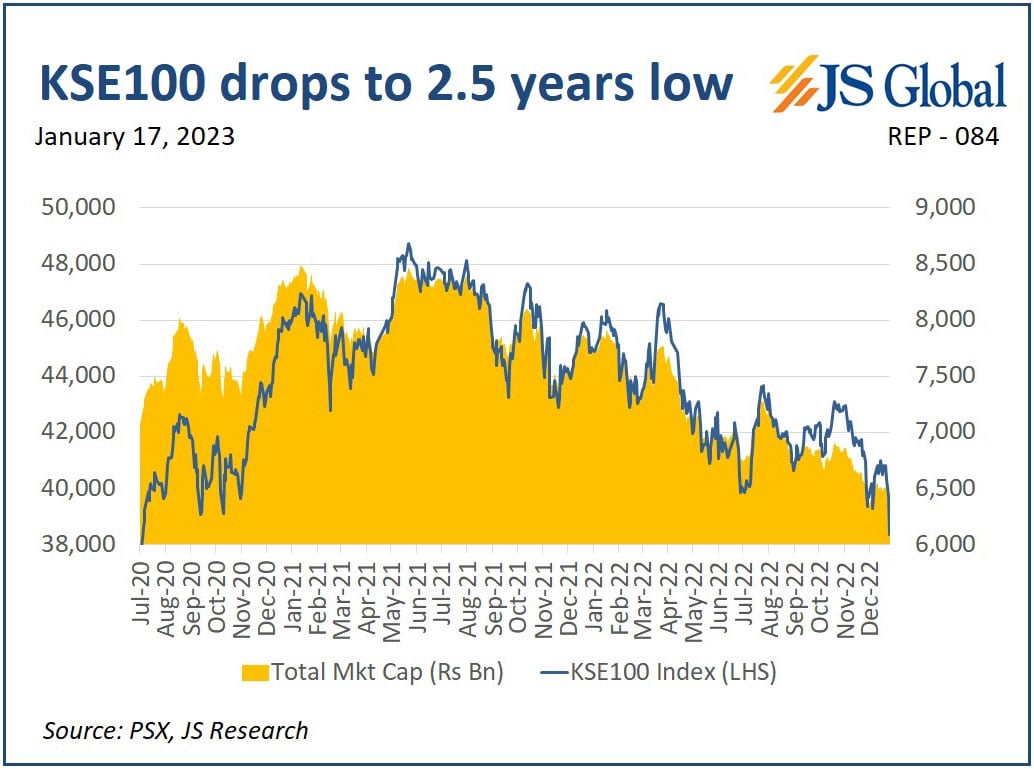

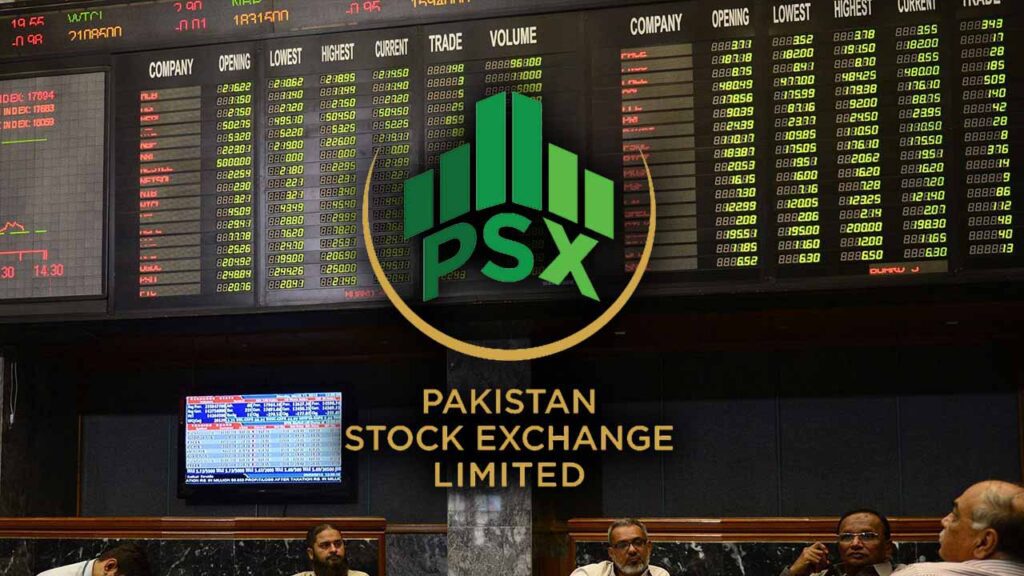

PSX plunges over 1,378 points to hit 2.5-year low as politics weighs

-

Latest News2 days ago

Latest News2 days agoThe IHC defers making a ruling on cases involving the same complaint against Sheikh Rashid.

-

Latest News3 days ago

Latest News3 days agoTo discuss the judges’ letter, the IHC CJ calls for a full court meeting.

-

Latest News2 days ago

Latest News2 days agoIran and Pakistan will cooperate on energy projects, such as the IP Gas Pipeline

-

Latest News2 days ago

Latest News2 days agoThe Lahore High Court Chief Justice has referred Fawad’s request for an extension of protective bail to a division bench.

-

Latest News3 days ago

Latest News3 days agoNawaz Sharif departs for a five-day personal visit to China.

-

Latest News3 days ago

Latest News3 days agoThe creation of a provincial enforcement authority is approved by the PunjabCM.

-

Latest News2 days ago

Latest News2 days agoThe Prime Minister extends an invitation to Australian companies to collaborate and exchange knowledge with Pakistani enterprises.

-

Education3 days ago

Education3 days agoThe president of Iran’s wife, Dr. Jamileh, claims that knowledge without ethics is worthless.