Business

Nationwide gas tariff hikes planned

-

Latest News3 days ago

Latest News3 days agoDay four of the AJK inflation protest begins as talks come to a standstill.

-

Latest News3 days ago

Latest News3 days agoShaheen Afridi and Babar Azam get special jerseys from PCB chairman

-

Latest News3 days ago

Latest News3 days agoPM Shehbaz Sharif revokes the GM and MD of PASSCO procurement

-

Latest News3 days ago

Latest News3 days agoPunjabi bakers decide to charge Rs. 15 for “roti.”

-

Latest News3 days ago

Latest News3 days agoCustoms recovered smuggled goods worth Rs 100 million.

-

Latest News3 days ago

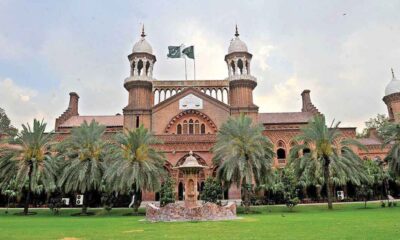

Latest News3 days agoLHC requested that NAB look into the fraud involving wheat imports.

-

Latest News3 days ago

Latest News3 days agoPresident Zardari urges resolution of AJK issues through dialogue

-

Latest News3 days ago

Latest News3 days agoNAB concludes its investigation into the Ramadan package corruption case.