Business

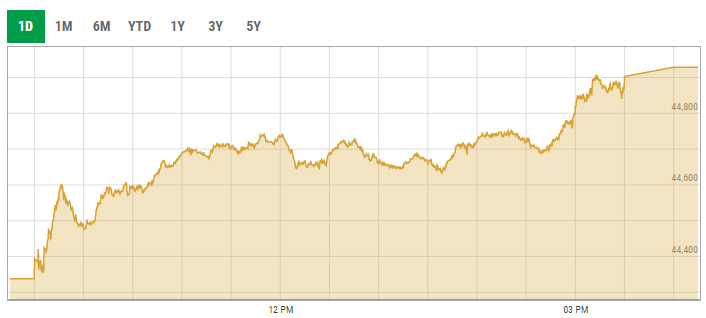

KSE-100 soars despite negative cues

-

Latest News3 days ago

Latest News3 days agoThe IHC defers making a ruling on cases involving the same complaint against Sheikh Rashid.

-

Latest News3 days ago

Latest News3 days agoIran and Pakistan will cooperate on energy projects, such as the IP Gas Pipeline

-

Latest News3 days ago

Latest News3 days agoThe Lahore High Court Chief Justice has referred Fawad’s request for an extension of protective bail to a division bench.

-

Business2 days ago

Business2 days agoThe IMF executive board will meet on April 29 to discuss the release of $1.1 billion to Pakistan, according to the report.

-

Latest News3 days ago

Latest News3 days agoThe Prime Minister extends an invitation to Australian companies to collaborate and exchange knowledge with Pakistani enterprises.

-

Latest News3 days ago

Latest News3 days agoOn a day-long visit, Prime Minister Shehbaz Sharif arrives in Karachi.

-

Latest News3 days ago

Latest News3 days agoWhen the DPO’s car flipped close to Quetta, three police officers were hurt.

-

Latest News3 days ago

Latest News3 days agoProject “Apna Chat Apna Ghar” in Punjab has been approved by CM Maryam.