The South Asian country is drawing to a close a $3 billion loan program with the International Monetary Fund that lasted nine months and was intended to address a balance-of-payments crisis that had put it in danger of defaulting last summer.

Pakistan has started negotiations for a new multi-year IMF loan program for “billions” of dollars, Finance Minister Muhammad Aurangzeb said in a Washington interview, with the final $1.1 billion tranche of that arrangement likely to be approved later this month.

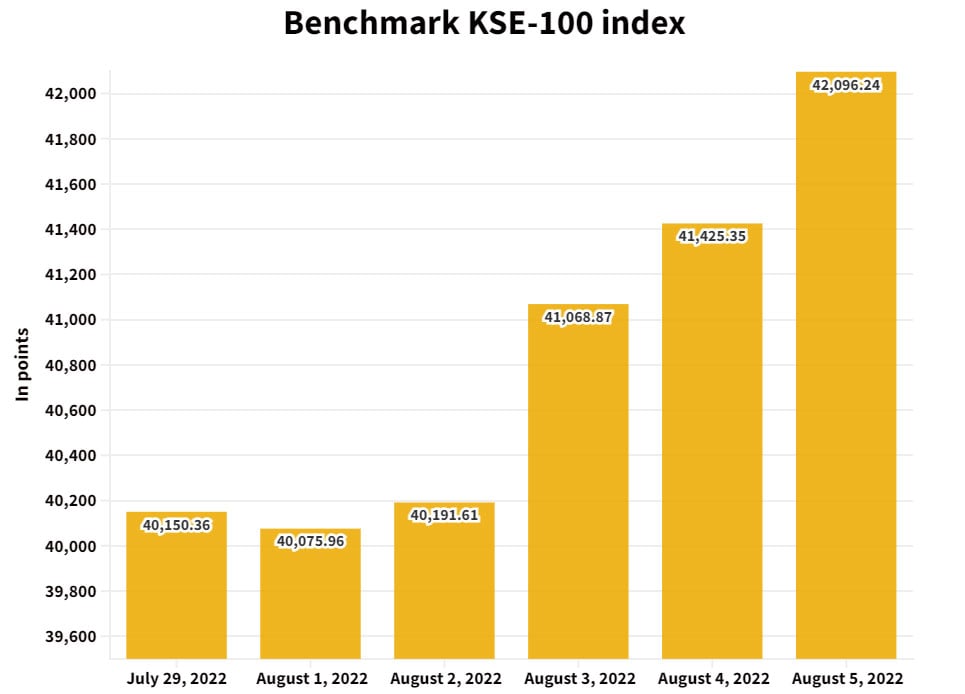

Aurangzeb, a former banker who started his job last month, stated, “The market confidence, the market sentiment is in much, much better shape this fiscal year.”

“We really started talking with the Fund this week to get into a larger and longer program for that reason,” he continued.

A representative for the IMF informed AFP that the organization is “currently focused on the completion of the current Stand-by Agreement program,” which is a nine-month program that is expected to be finished soon.

The spokesperson went on, “The Fund staff is prepared to start initial talks on a successor program as the new government has expressed interest in a new program.”

“Third-year curriculum”

Aurangzeb’s journey to Washington will also include attendance at the IMF and World Bank’s spring meetings, which begin in earnest on Tuesday and have two distinct goals: supporting the world’s most indebted countries and aiding governments in the fight against climate change.

The IMF’s revised World Economic Outlook will be released to coincide with the start of the meetings, which bring together academics, representatives from the private sector, civil society, finance and development ministries, and central bankers to debate the state of the global economy.

Allegations of election tampering plagued Pakistan’s February 2019 elections, resulting in the imprisonment and disqualification of opposition leader Imran Khan and the persecution of his Pakistan Tehreek-e-Insaf (PTI) party.

The unstable alliance that surfaced, headed by Shehbaz Sharif, is currently charged with bringing about an economic recovery through the imposition of several controversial austerity measures.

Aurangzeb stated, “I do believe that we will be requesting for a three year program.” “Because in my opinion, that is what we need to help carry out the structural reform agenda.”

He went on, “I do think we’ll start getting into the contours of that discussion by the time we get to the second or third week of May.”

Keeping the US-China rivalry in check

Pakistan is in a difficult situation as the two nations have started an expensive trade war because of its strong economic ties to both China and the United States.

When asked how the Sharif government intends to handle its commercial relationships with the two largest economies in the world, Aurangzeb responded, “From our perspective it has to be a and-and discussion.”

“The United States is our biggest trading partner, and it has consistently provided us with support and assistance with our investments,” he stated. Therefore, that relationship will always be extremely important to Pakistan.

He was alluding to the nearly 1,860-mile-long China-Pakistan Economic Corridor, which was built to offer China access to the Arabian Sea, when he added, “On the other side, a lot of investment, especially in infrastructure, came through CPEC.”

According to Aurangzeb, Pakistan has a “very good opportunity” to participate in the trade war on par with nations like Vietnam, whose exports to the US have increased significantly as a result of tariffs placed on some Chinese items.

He stated, “We already have a few examples of that working.” “However, we must truly scale it up.”

reform initiative

Pakistan is currently engaged in a privatization campaign to sell off its underperforming state-owned businesses (SOEs) as part of the structural reform package agreed upon by the previous government.

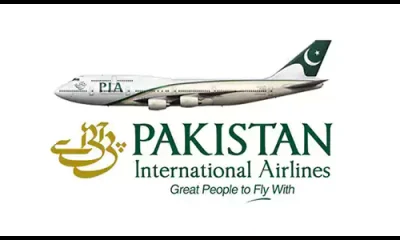

The nation’s flag carrier, Pakistan International Airlines, is the first SOE on the list.

In regards to potential bidder interest, Aurangzeb stated, “we will find out in the next month or so.”

He said, “Our goal is to proceed with that privatization and see it through to completion by the end of June.”

Other businesses may soon follow if the government’s privatization of the PIA proceeds smoothly.

He declared, “We’re building a whole pipeline,” and added, “We want to really accelerate that over the next couple of years.”

Business1 day ago

Business1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago

Business1 day ago

Business1 day ago

Pakistan1 day ago

Pakistan1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago

Latest News1 day ago