Business

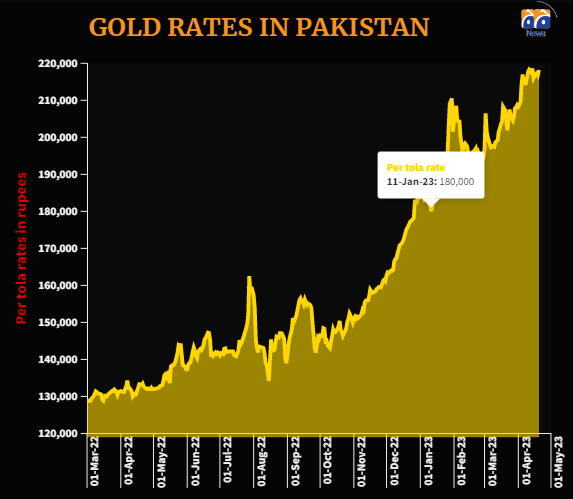

Gold nears historic high as rupee recovers

-

Latest News3 days ago

Latest News3 days agoThe PML-N Punjab chapter convenes today to discuss organizational issues.

-

Latest News3 days ago

Latest News3 days agoIn Punjab, the PDMA issued an alert for rain and snowfall.

-

Business3 days ago

Business3 days agoThere are US$13,280.5 million in foreign exchange reserves in Pakistan.

-

Latest News3 days ago

Latest News3 days agoSaad Rafiq: Ali Amin Gandapur’s threat to storm Islamabad is a major issue.

-

Latest News3 days ago

Latest News3 days agogovernment starts a trail patrol in the Margalla Hills of Islamabad

-

Latest News3 days ago

Latest News3 days agoMaryam Nawaz: The court petitioned against the Punjab Chief Minister for wearing a police uniform.

-

Business3 days ago

Business3 days agoNIMA seminar to increase Pakistan’s ship recycling industry’s capacity

-

Latest News3 days ago

Latest News3 days agoIHC will consider a case today challenging the election of the Senate chairman and deputy