Business

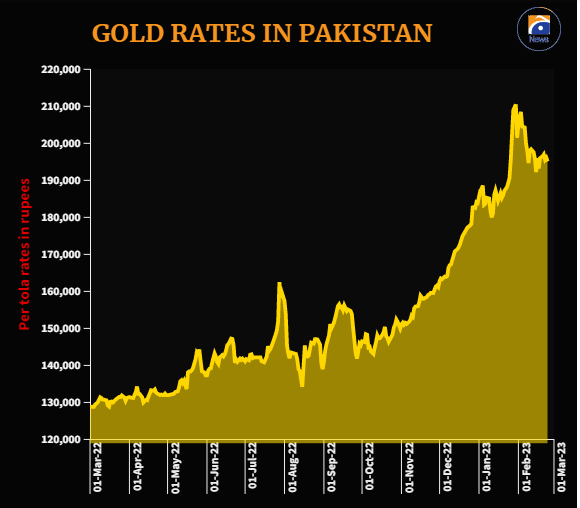

Gold retreats once again in Pakistan, per tola price declines by Rs1,000

-

Business3 days ago

Business3 days agoThe IMF executive board will meet on April 29 to discuss the release of $1.1 billion to Pakistan, according to the report.

-

Latest News1 day ago

Latest News1 day agoThe PML-N Punjab chapter convenes today to discuss organizational issues.

-

Latest News3 days ago

Latest News3 days agoIHC prevents Sher Afzal Marwat of the PTI from being arrested by Punjab police

-

Latest News3 days ago

Latest News3 days agoMadhubala, the elephant, will be moved to Safari Park starting next month.

-

Business2 days ago

Business2 days agoExchange achieves all-time high: KSE-100 index surpasses 72,500 points

-

Latest News2 days ago

Latest News2 days agoLeading the Green Pakistan Initiative in Malam Jabba is the Pakistan Army.

-

Latest News2 days ago

Latest News2 days agoIn Punjab, the PDMA issued an alert for rain and snowfall.

-

Business2 days ago

Business2 days agoThe investment plan for K-Electric will be audited every three months.