Business

Mini-budget likely to be passed in National Assembly today

-

Latest News4 hours ago

Latest News4 hours agoIn KP rain-related incidents, ten people died.

-

Latest News5 hours ago

Latest News5 hours agoPunjab takes action against factories that generate smoke.

-

Latest News4 hours ago

Latest News4 hours agoPM Shehbaz will meet with Saudi ministers and speak at the WEF special session today.

-

Business4 hours ago

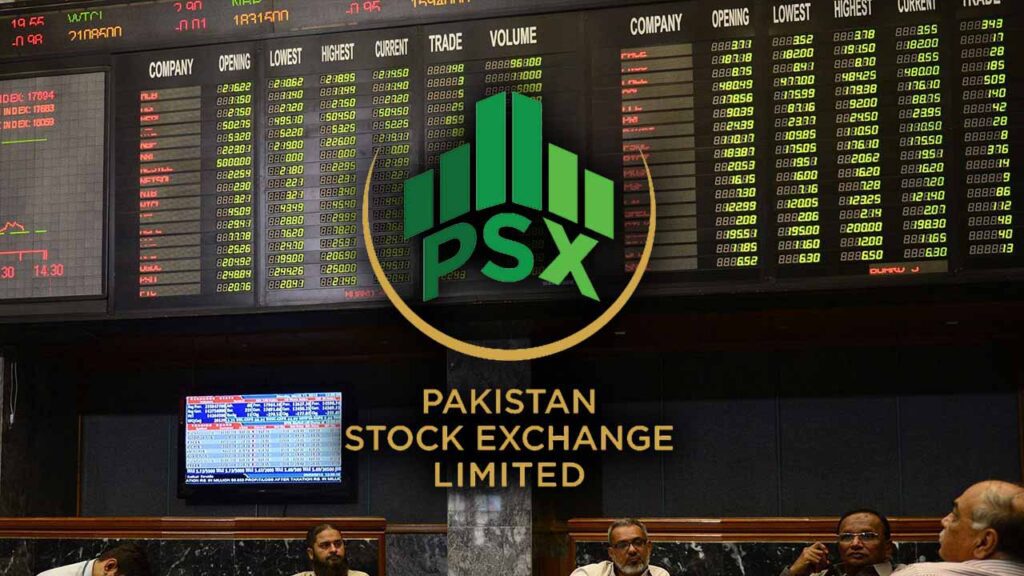

Business4 hours agoOver 500 points are lost by PSX stocks during intraday trading.

-

Latest News4 hours ago

Latest News4 hours agoThe green colour of WhatsApp ‘angers’ some users.

-

Latest News4 hours ago

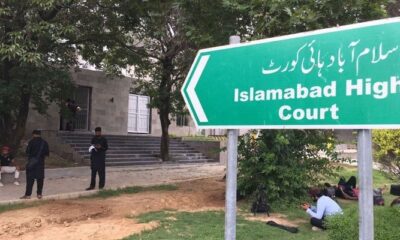

Latest News4 hours agoAudio leaks case: FIA, PTA, and PEMRA pleas seeking Justice Sattar’s recusal dismissed

-

Latest News4 hours ago

Latest News4 hours agoThe nomination of Ishaq Dar as deputy prime minister raises concerns.

-

Business4 hours ago

Business4 hours agoDespite global tides, Pakistan’s economy is recovering, according to Governor SBP