Business

Gas crisis to aggravate as supplier refuses to deliver LNG cargo

-

Latest News1 day ago

Latest News1 day agoPoliovirus discovered in ten additional sewage samples

-

Business1 day ago

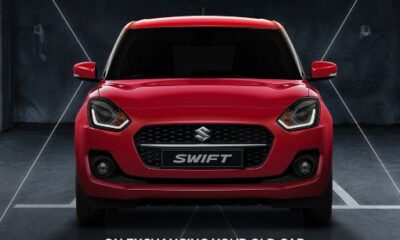

Business1 day agoSee the new rates when Pak Suzuki announces a significant decrease in car costs.

-

Business1 day ago

Business1 day agoPakistan will host an IMF team in May to discuss a new loan.

-

Latest News1 day ago

Latest News1 day agoUS Ambassador Donald Blome praises Maryam’s portrayal of the Chief Minister of Punjab.

-

Latest News1 day ago

Latest News1 day agoNews anchors strongly condemn the incident and demand justice in the wake of the May 9 tragedy.

-

Business1 day ago

Business1 day agoIn FY2024, SRB tax revenue soars to Rs 185.2 billion.

-

Latest News1 day ago

Latest News1 day agoFO spokesperson: Pakistan will not cede bases to any foreign government.

-

Latest News1 day ago

Latest News1 day agoPakistan releases their England against Ireland team, and Hasan Ali is back.