The benchmark KSE-100 Index increased by more than 1.50 percent on Monday, driven by the possibility of significant Saudi investment. Investors are now more optimistic that the central bank will soon begin a cycle of interest rate cuts, and another IMF programme is very much on the horizon.

The KSE-100 Index increased by 910.25 points, or 1.27 percent, by 1:29 pm PST to close at 72,812.34, having reached an intraday high of 73,060.74.

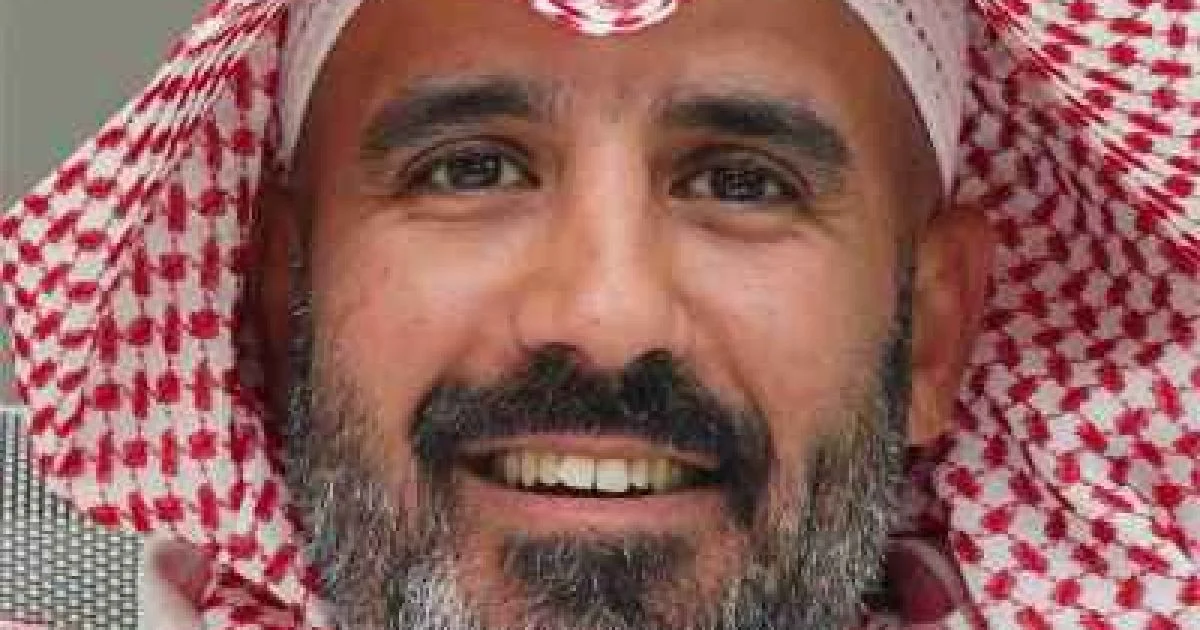

Additionally, on Monday, Ibrahim Al Mubarak, the deputy minister of investments for Saudi Arabia, stated that his nation preferred Pakistan’s economic growth and thought it was the best place to make investments.

The news is definitely good for equities that have been cheap since their market capitalization peaked in 2017, as many industries—energy, agriculture, technology, and mining being the primary ones—can now attract much-needed foreign investment.

The inflation of Pakistan

The consumer price index (CPI) for April increased by 17.3 percent, the lowest level since May 2022. This led to the benchmark index rising by 1244.45 points, or 1.76 percent, during the last session on Friday of last week.

This indicates that, like in March, annual inflation declined for the fourth straight month in April and stayed below the current record high interest rates of 22 percent. like a result, the State Bank of Pakistan may decide to begin reducing interest rates at its upcoming meeting on June 10.

While the pattern seen on Friday was also influenced by a market correction, the persistence of this most recent upswing indicates that investors are anticipating an economic recovery in the context of falling inflation and impending Saudi Arabian investment.

IMF APPEAL

In the meantime, the IMF continues to play a significant role in Pakistan, influencing not just public policy but also private sector initiatives and the lives of common citizens. Furthermore, the market was undoubtedly helped by the world’s largest lender’s most recent announcement of the upcoming transaction negotiations.

The Bretton Woods Institution said on Sunday that a delegation was scheduled to visit Pakistan this month to talk about a new initiative, prior to Islamabad starting the annual budget-making process for the upcoming fiscal year.

Although Pakistan’s $3 billion short-term programme helped prevent a sovereign default last month, Prime Minister Shehbaz Sharif’s administration has emphasised the necessity for a new, longer-term initiative.

The IMF responded to Reuters via email, saying that a mission is anticipated to visit Pakistan in May to review the FY25 budget, policies, and reforms under a proposed new programme for the wellbeing of all Pakistanis.

MERCURABLE BY SAMPLE

Meanwhile, it has been claimed that Saudi Crown Prince Mohammed bin Salman would pay a visit to Pakistan later this month. The kingdom has been making massive investments all over the world in an effort to become a more significant player in world affairs.

It makes sense that after years of political unrest and economic hardship, his presence and the Saudi investment will aid Pakistan in establishing itself as a desirable location for investors.

The explanation is straightforward: Saudi Arabia continues to be a significant actor in world politics. Nonetheless, the globe has begun to view MBS, the crown prince’s nickname, as a role model due to his policies of diversifying his nation’s economy and elevating the kingdom to a centre of commerce.

Business10 hours ago

Business10 hours ago

Latest News10 hours ago

Latest News10 hours ago

Business10 hours ago

Business10 hours ago

Pakistan10 hours ago

Pakistan10 hours ago

Latest News10 hours ago

Latest News10 hours ago

Latest News10 hours ago

Latest News10 hours ago

Latest News10 hours ago

Latest News10 hours ago

Business11 hours ago

Business11 hours ago